SCM Capital on Behalf of Sterling Financial Holdings Company Plc, announces the result of the Rights Issue of 7,197,604,531 Ordinary Shares at N4.00 per share on the basis of 1 new Ordinary Share for every 4 Ordinary Shares held as at the close of business on Tuesday, 06 August 2024

- A total of 1,217 shareholders applied for 9,770,795,357 ordinary shares of 50k each at N4.00 per share on the basis of one (1) new ordinary share for every four (4) ordinary shares held as at August 06, 2024, valued at N39,083,181,428.

- A total of 57 applications for 528,036,643 ordinary shares were outrightly rejected and 1 application for 11,274,113 was partially rejected as follows:

– Forty‑Two applications for 110,386 ordinary shares valued at 441,544, were rejected on the grounds that the applicants were non‑qualified shareholders and ineligible as of the qualification date;

– Fifteen applications for 527,926,257 ordinary shares valued at N2,111,705,028 were rejected as applications not cleared by CBN; and

– One shareholder, who was provisionally allotted 1,274,113 ordinary shares, applied for a total of 11,274,113 ordinary shares valued at N45,096,452. However the CBN approved only N6,093,848, resulting in the rejection of the application for 9,750,651 ordinary shares valued at N39,002,604. - Total valid applications processed were thus 9,233,008,063 ordinary shares of 50k each at N4.00 per share valued at N36,932,032,252 received from 1,160 shareholders.

- The issue was therefore 128.28% subscribed.

- The CBN approved 26,639,710,492 for allotment in respect to the rights issue resulting in the allotment of 6,659,927,623 ordinary shares, while N10,292,321,179.15 was also cleared as excess monies and this has been earmarked for a private placement in respect to the shareholder with the residual allotment in the rights issue.

- 1,068 shareholders with provisional allotment of 3,311,135,220 ordinary shares valued at N13,244,540,880 accepted their rights in full and were fully allotted.

- 39 shareholders with provisional allotment of 151,362,421 ordinary shares partially accepted 66,657,607 ordinary shares valued at N266,630,428, renouncing the balance of 84,704,814 ordinary shares.

- 9 shareholders with provisional allotment of 193,911,262 fully traded their rights; two other shareholders with a provisional allotment of 1,963,515 ordinary shares traded 1,823,015 ordinary shares while renouncing 140,500 ordinary shares; and one shareholder with a provisional allotment of 1,750,000 ordinary shares traded 1,450,000 ordinary shares and accepted their remaining rights of 300,000 ordinary shares. Thus, a total of 197,184,277 ordinary shares, valued at N788,737,108, were traded and acquired by 53 new subscribers.

- Total provisional shares allotted were thus 3,574,977,104 ordinary shares valued at N14,299,908,416.

- A total of 84,845,314 ordinary shares, valued at N339,381,256, were partially renounced, while 3,537,782,113 ordinary shares, valued at N14,151,128,452, were fully renounced. This brings the total renounced shares to 3,622,627,427, with a combined value of N14,490,509,708.

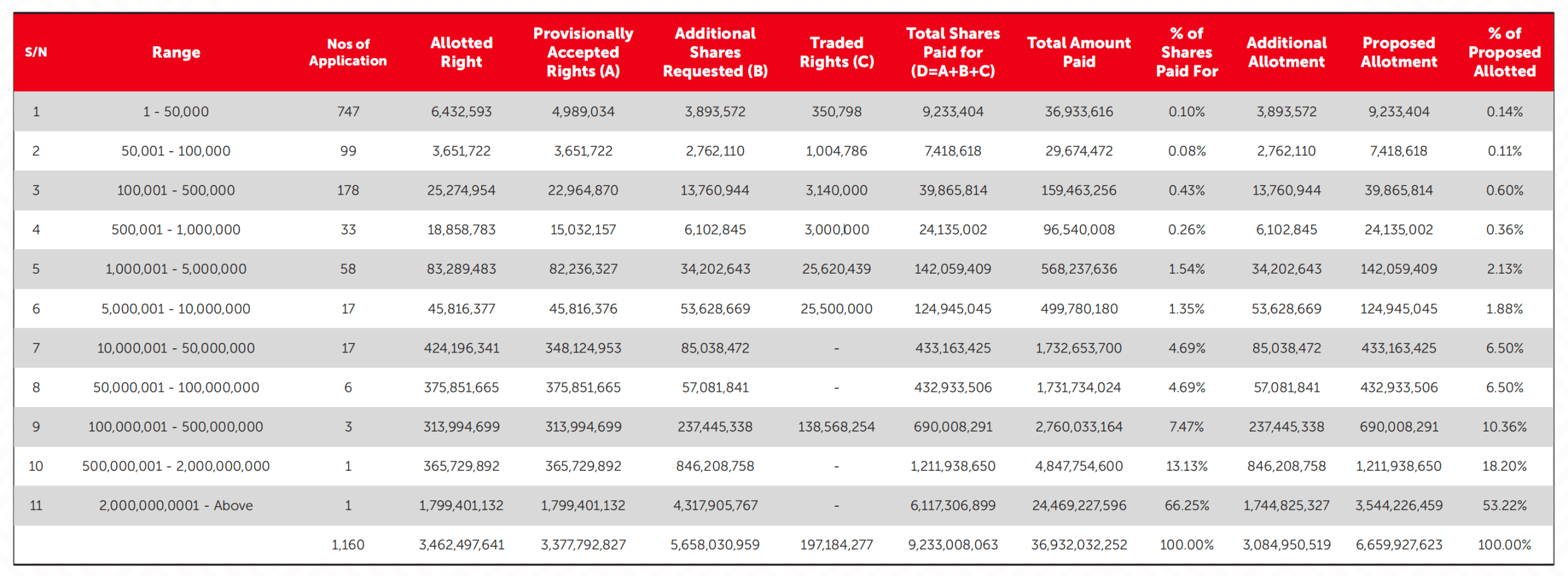

- A total of 615 subscribers fully accepted their provisionally allotted rights of 567,418,196 ordinary shares and applied for an additional 1,340,125,192 shares, which were allotted in full. One subscriber, who fully accepted its allotted rights of 1,799,401,132 ordinary shares, applied for an additional 4,317,905,767 shares, was allotted an additional 1,744,825,327 ordinary shares only in line with CBN’s interim clearance of N26,639,710,492 available for allotment bringing the total allotment to 92.53% of the Issue. The detailed allotment analysis is provided below:

The above stated basis of allotment, as well as this announcement has been cleared by the Securities and Exchange Commission (“SEC”). Shares allotted will be credited not later than June 3, 2025, being five (5) business days after clearance of the basis of allotment by the SEC, to the CSCS accounts of allottees by the Registrars to the Issue, Pace Registrars Limited at 8th Floor, Knight Frank Building, 24 Campbell Street, Lagos.

In accordance with the SEC Directive on Dematerialization of Share Certificates, allottees without CSCS accounts will have their shares credited not later than June 3, 2025, being five (5) business days after clearance of the basis of allotment by the SEC, at the CSCS using a Registrar Identification Number.

All surplus/rejected applications monies will be returned not later than June 3, 2025, being five (5) business days after clearance of the basis of allotment by the SEC.